To issue a loan in an MFI (microfinance company) is much easier and more convenient

Simplicity is associated with the loyal requirements of companies to their borrowers. They are not required to have a positive credit history, without long historical delays (long delays are understood as missed payments over 60-90 days). It is enough just not to have current overdue debts.

Much more loyal ifc are also to the employment of customers, their confirmation of their income. Unlike banks, which always require the client to have employment, filling in the employer's data in the questionnaire, IFC do not always request information about the work. On the contrary, this data is additional and can increase the chances of approval at a lower rate.

For what reasons do banks refuse to the client?

Banks are constantly improving programs for analyzing and verifying customers. A large number of checks fall in many of them at the first stage – automatic. The most frequent and common reasons for refusals to apply in banks can be divided into three categories

Credit history refusals

Any deviations in the credit dossier of the client from the established minimum requirements of the creditor are a refusal. Banks do not have uniform requirements. As well as there are no specific instructions on which delays will pass and which will not. The applicant's absence of current overdue debts is sufficient. Or closed delinquencies over 60-90 days in the last 3-5 years.

This also includes situations where the client has a large credit load. A large number of active loans (the norm for most banks is 3-5 active obligations to creditors) for large amounts, albeit paid without a single delay, do not like banks. Excessive debt load can lead to delinquencies.

Business reputation of the client

This includes any negative information that may be detected by a security officer when checking the client against various databases. Administrative or criminal liability.

Negative data on the employer

Banks pay sufficient serious attention to the employer's verification. The company should be engaged in activities understandable to the bank, not fall under the category of "one-day companies" created specifically for issuing loans, etc.

What are the main requirements of ifc to its customers?

The requirements for the client, whom the microfinance company is ready to consider and in the absence of reasons for refusing to lend, are similar to the requirements of banks. Just MFIs have simplified them as much as possible so as not to deprive themselves of an additional flow of customers who, for one reason or another, cannot issue a loan from a bank.

- have citizenship of the Russian Federation;

- be between the ages of 18 and 75 (in most banks the age limit is 60-65, with rare exceptions up to 70-80 years);

- have a passport and a second document (SNILS);

- availability of a mobile phone and the ability to fill out an application online;

- the client must have a personal bank card (this method of receiving money is in all MFIs, less often – on electronic wallets, etc., by the way, only on the card is available registration and receipt of an interest-free loan);

- absence of current delinquency on loans.

Why are MFIs more loyal to customers with a negative credit history?

The thing is that banks are obliged to form reserves for possible losses on issued loans. Such a requirement for the formation of a loan portfolio arises from the Regulation of the Central Bank of the Russian Federation No. 590. It states that each loan, in accordance with the credit history of the client who received this loan, is assigned a certain level of risk of non-payment.

The higher the risks (they increase or decrease on the basis of data on the presence or absence of delinquencies in the borrower's credit history), the more reserves need to be created from the bank's own capital. Therefore, the bank is better to refuse a client with a large number of delinquencies and issue a loan to a more reliable borrower.

The one who did not have significant missed payments or is a salary client of the bank. Transfer of wages to the bank's card is an additional guarantee for him that the loan will be repaid.

They can approve a client with negative data in the credit history. Loan rates are ten times higher than standard interest rates on bank loans. They allow microfinance companies to compensate for possible risks of defaults on loans issued.

Is it possible to apply for a loan in the IFC without checking the credit history?

The most important check is to analyze the quality of credit history. Large companies check the client for all four largest BKI – NBKI, OKB, Equifax and even look at the Credit Bureau of russian Standard. What many banks do not do, in particular, when checking customers on mortgage applications.

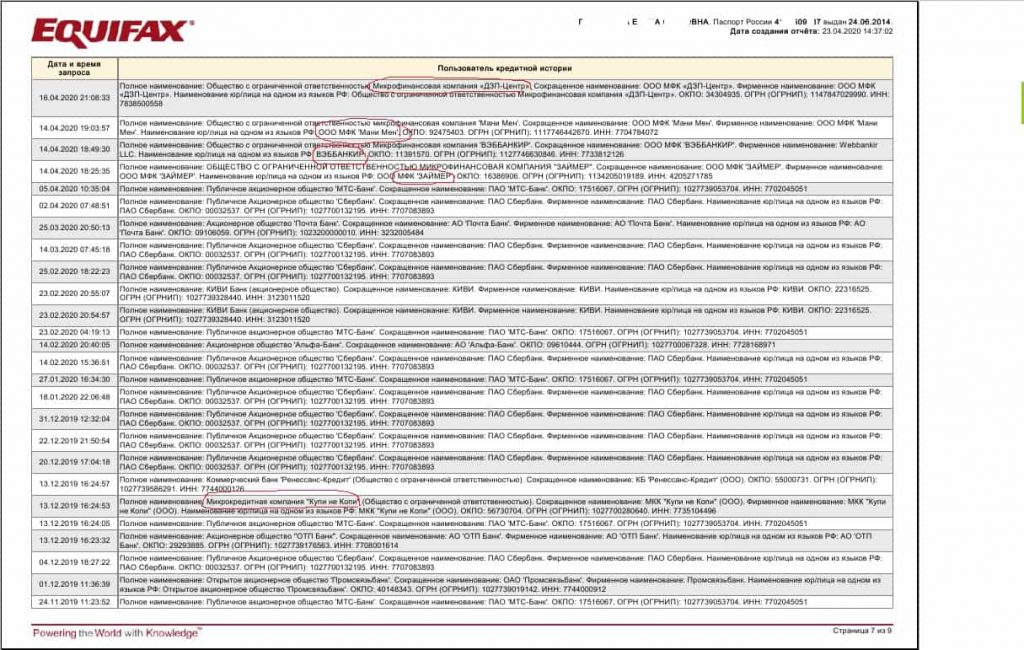

If MFIs do not check the credit history of the client, they will quickly go bankrupt. Making sure they're checking it is easy. The client can apply to several companies and then request a BKI report. It will include all lenders who have been interested in the applicant's credit dossier. As shown in the screenshot of the Equifax credit history report.

A loan in an MFI is an opportunity to improve the credit history of customers with negative records in the BKI

A loan issued in an MFI gives a chance to a client with a bad credit history to improve it. It is enough to return the loan in time and a record of this will necessarily be displayed in the borrower's credit dossier. Many companies offer a separate service to improve credit history, focusing on the fact that information about successful repayment will be transferred to the BKI.

Conclusions

A client with a bad credit history in the presence of refusals in several banks is sometimes better to consider the registration of a loan in the MFI. Especially if we are talking about a small amount. Or the delay was closed recently – about a month ago.

If there is any doubt that the information about the admitted delays is correctly entered in the BKI, the client should request a credit history report. Information about the closure of the delinquency or the entire loan arrives there late (within 5 working days) and before applying for a new loan, it is always better to check your credit dossier.