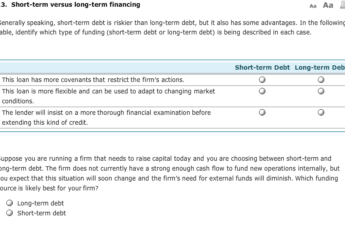

If you need fast money, you can turn to a short term loan online. The process for these loans is simple, and you’ll have your money in your bank account the same day. There are no credit checks and no hidden fees. The best part is that the interest rates are low.

Quick approval

Getting a short term loan online is a very simple process. You only need to fill out a simple application form and submit it within a few minutes. If approved, you can receive the money in as little as one business day. However, you need to read the terms and conditions carefully to make sure that you understand all the information that is required of you.

Online short term loans are very popular, especially with those who have bad credit or no credit history. Your credit score isn’t the only criterion that determines whether or not you can get a loan, but it is a factor. If you have a good credit score, you can expect to receive lower interest rates and more flexible terms. However, if you have a poor credit history, you may still be able to get a loan. A secured loan, such as a title loan, is another option for people with bad credit.

These short term loans are available through several different companies. Some offer instant online approval, while others require a long approval process. You should look for a company that offers a simple application process. Make sure to read all the terms and conditions and choose the one that is most suitable for your situation.

While many online lenders can approve you in a matter of minutes, if you have bad credit, you might not qualify for a large loan amount. However, a number of online lenders offer bad credit loans, and you should compare different lenders and loan features before choosing one. Using a prequalification tool, such as NerdWallet, will help you compare rates and features for different short term loans.

No credit check

No credit check short term loans online are easy to apply for and you could get the money you need in as little as one hour. If there are no hiccups, the money could be in your account the next day, but in some cases you might have to wait up to a week. Traditional lenders perform hard credit checks on borrowers to see how reliable they are. However, no credit check loans do not require these detailed reports.

Applicants can take no credit check loans for various purposes, including debt consolidation, which can help a person get a lower interest rate and consolidate all of their debts into one. In addition, no credit check loans will not affect your credit score because most online lenders will conduct soft credit checks using free information sources. Since no credit check loans are cash advances, they are a great way to build or improve your credit.

Once you have completed your application, lenders will review the data and send a response. Make sure you read the loan documents carefully and pay attention to the interest rate and terms. Once you are approved, you will have access to your funds the next business day. Some lenders also offer same day funding for approved borrowers.

Most payday lenders don’t perform a hard credit check on applicants. In fact, they advertise “no credit check” payday loans and charge no credit check fees. However, some lenders do perform a soft credit check but it rarely impacts your score.

No hidden fees

If you’re in need of emergency funds but don’t want to deal with credit check delays, same-day payday loans online are a great option. These loans can range from $50 to $5,000 and are approved by lenders the same day. There are no hidden fees or application fees to worry about, and they don’t impact your credit score at all.

However, you should keep in mind that short-term loans have higher interest rates than long-term loans. These loans may also come with additional fees, such as origination or late payment fees. Before you agree to a deal with a lender, make sure you understand all the terms and fees.

Many online short-term loan platforms offer a no-fee service but this isn’t the case. Many of them are just out to make a profit. You’ll have to pay interest for the money, so avoid those sites that charge unnecessary hidden fees. Also, be sure to choose a lender with strict privacy policies.

Another way to find the best short-term loans online is to compare rates and services. There are many lenders online, and not all of them have high interest rates. If you find one that suits you best, don’t hesitate to apply. Most of these lenders can process your application within a matter of minutes.

Low interest rates

There are a number of websites that offer low interest rates on short term loans online with same day payout. Most of these websites are not lenders themselves but rather connect borrowers to local lenders. When choosing a lender, it is important to have a strong credit score in order to qualify for a lower interest rate. Also, short term loans have a much shorter repayment period than other types of loans, so it helps to have a solid financial history. Moreover, most short term loans are backed by collateral. The more collateral you put up, the better deal you can get.

The application process is simple and fast. The lenders can approve your loan application in as little as 24 hours. Just make sure that you meet all the criteria and provide the required information. You can also get same day cash advances through online lenders if you can meet the requirements. You will need to provide the lender with your bank account information and a valid e-signature.

The process of obtaining a payday loan online is fast, easy, and secure. There are plenty of lenders online that provide these loans. Many of these websites use encryption technology to protect your information. You also have the freedom to apply from home or anywhere in the world. By pre-qualifying for a loan online, you can compare rates and loan features from a number of lenders. Even better, you can use sites like NerdWallet to pre-qualify without harming your credit score.

Some online providers offer 0% interest for 60 days. After that, you’ll have to pay a percentage of your borrowed money each month. This is helpful if you need cash to pay your summer bills or when you need to save for an expensive vacation. You can also use this loan to build your credit score while putting some money aside for emergencies.

Direct deposit to your bank account

If you need fast cash, one of the most convenient ways to get it is with a short term loan that can be paid directly into your bank account. This type of loan can be approved in as little as two minutes, and the money can be in your account the same day or the next business day. You can even find a lender in your area that can provide you with a payday deposit loan that can hit your bank account the same day.

These loans are perfect for those who need quick cash, but do not want to worry about waiting for checks to clear or leaving their home. Direct deposits are also quick and easy to access. They can be approved within minutes and deposited into your bank account the same day, depending on the lender’s policies.

Most lenders can provide same day deposit loans to those who need them, but keep in mind that not all of them offer this service. It’s important to compare lenders to get the best rate, and read online reviews before making a decision. Most lenders that offer direct deposit loans only require a small amount of information, including your bank account number and routing number.

If you have a bad credit history, you can still find a lender that offers same-day payout loans online. Many of these lenders use a peer-to-peer model that matches applicants with lenders. In order to qualify, you must be a U.S. citizen or legal permanent resident and have a monthly income. Once you’ve been approved, you’ll receive offers from direct lenders within one to five business days.