You can apply for a short term loan for 12 months if you are between the ages of 21 and 62 years and have worked for at least two years. This type of loan is perfect if you need instant cash, but be aware that interest rates are usually high and you should limit the amount you borrow.

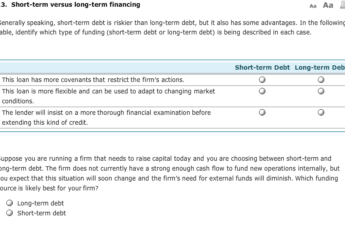

Interest rates

If you need to borrow money for a short period of time, a short term loan could be the solution. These loans have a minimum duration of three months and can help you deal with financial emergencies. In 2015, the Financial Conduct Authority (FCA) introduced a cap on short-term loan interest rates. This means that the interest rate charged will never be more than 0.8% per day.

Different lenders offer different types of short-term loans. Some offer six-month bad credit loans and others offer loans up to 12 months. They have different rates and repayment terms, so you need to compare them carefully. Different types of short term loans have their pros and cons. Some offer longer loan terms and lower interest rates, while others offer shorter repayment periods. While it’s wise to compare and contrast different financial products, you can find a loan that meets your needs and budget.

Fees

If you are in need of instant cash, a 12-month loan can provide the necessary funds. However, the interest rates charged on such loans are quite high. To avoid paying excessive interest, you should limit the amount you borrow. Generally, these loans are available to people with a poor credit score.

There are many factors to consider when choosing a lender for short term loans. Interest rates and fees can vary widely from lender to lender. In addition to high interest rates, short-term loans can come with additional fees and processing costs. It is advisable to choose a lender that charges competitive rates and charges.

Fixed fees are another problem with short-term loans. Most lenders require borrowers to make payments once or twice a week or daily. This can be punishing if you have irregular cash flow. However, it is possible to find a lender that offers discounts for early repayment. A business owner should look for a lender who is willing to work with borrowers, even during tough financial times.

Before deciding on a short-term loan, consider your monthly income and your monthly budget. This will help you determine the amount and type of loan you need. In addition, make sure you understand how you will pay back the loan. Many short-term loans require a higher monthly payment than other lending options, and this can be very stressful for your budget.

Prepayment penalties

If you’re planning to pay off your short term loan early, you need to understand the terms of the loan agreement. This is because some lenders will charge you a prepayment penalty. Prepayment penalties are generally assessed to protect the lender from losing interest income from early payments. These penalties can be substantial.

If you’re going to make smaller principal payments, you can ask the lender to waive the penalty. You can also negotiate a reduced prepayment fee for each year of the loan term. In many cases, you can negotiate a prepayment penalty of zero percent for the last 12 months. But it is important to know that some lenders charge a prepayment penalty for most of the loan term, even if you choose to repay it early.

Prepayment penalties vary from lender to lender. Make sure to ask for a prepayment disclosure document from your lender. They can range from a few hundred dollars to 2% of the loan balance. Some lenders even use a sliding scale for these fees based on how long you have the loan. It is important to understand the terms of a prepayment penalty before signing any loan agreement.

Although it might sound like a punishment for paying off your short term loan early, a prepayment penalty protects the lender by ensuring that they can recover their interest. In contrast, an amortized loan has scheduled periodic payments that pay off the interest expense first and then reduce the principal.

Eligibility requirements

When applying for a short term loan, it’s important to meet a few specific requirements. While many lenders have minimum credit score requirements and income requirements, others may have more specific requirements related to debt-to-income ratio or the manner in which the loan will be used. Some lenders charge origination fees, while others do not. To get started, fill out an online application.

Short term loans can be a lifeline, especially for individuals with bad credit or small businesses. These loans are typically shorter in duration, ranging from a few months to a year. Because they have a shorter repayment period, they are less costly in the long run. Also, because the amount is small, the monthly payment is not as high, which makes them a better choice for those with bad credit or for those looking for quick funding.

Availability

If you need money urgently, you might want to consider applying for a short term loan. These loans are available both in person and online, and are usually disbursed within a day. Typically, the repayment term is 12 months. You can repay the loan via direct debit from your salary account or ECS, or you can write a post-dated cheque.

These loans are unsecured and have a 12 month repayment period. They have high interest rates compared to a regular personal loan, but are ideal for people who need immediate cash. They have no collateral requirements and can be easily applied for online. Even if you have a bad credit score, you can still qualify for these loans.

Applications

You can apply for a 12-month loan in person or online, and you can have the money within 24 hours. You will need a checking account and a source of income to qualify. You can also opt to pay off the loan with a direct debit from your salary account or an ECS, or post-dated cheques.

The loan amount is usually small and you can repay it over a year. These loans have a higher interest rate than regular personal loans. However, they are useful for those who require instant cash. The maximum tenure is one year, so they can be a good choice for emergencies. You can apply for these loans even if you don’t have an excellent credit score.

Short term loans are great for people with bad credit, because you can borrow a small sum of money for an incredibly short period of time. Since the payment terms are shorter than traditional loans, you will pay back less money in the end. In addition, you won’t have to worry about making large payments each month.

Payday loans are popular options for emergency situations, but their interest rates can be high. You can expect to pay as much as 10% per month, so be sure to consider the repayment terms carefully. When considering 12-month loans, you should be aware of different interest rates, processing fees, and other charges.