If you’ve been considering applying for a short term loan, you may be wondering how the process works and what your requirements are. This article covers the short term loan application process, the requirements you must have to get approved, the repayment period, and the cost of borrowing the money. With a few clicks, you can begin your application for a short term loan and start the process of getting the money you need.

Simple application process

Applying for a short term loan online is easy, and the process tends to be quick. You can apply from your home, office, or any other location as long as you have access to the internet. You can often even apply 24 hours a day. In addition to easy application processes, researching online loan companies is fast and easy.

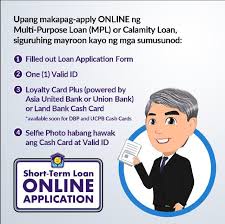

When you apply for a short term loan online, you will first need to provide basic information about yourself, such as your name, address, and email address. You’ll also need to supply information about your income and employment. You’ll also need to tell the lender why you’re applying for the loan and the amount you’re applying for. The lender may also run a soft credit check to determine your eligibility.

Unlike lines of credit, short term installment loans are designed for a short-term need. They don’t require a high credit score and give you an amount that you can repay in ten or five equal weekly or bi-weekly installments. They can be paid back as quickly as one day or as long as two years. Short term loans are a convenient way to access funding when you need it most.

When applying for a short-term loan, make sure to provide an income source with a current address. Some lenders will allow you to include proof of income in the application process, like a bank account. You should always make sure to check the terms and conditions before applying for a loan. If your income is lower than your monthly expenses, you can extend the repayment period.

Applying for short-term loans online is a fast and easy process. Most of the lenders will perform a credit check, but there are also lenders that don’t. Most of these lenders will accept you without a credit check, but they may still require some extra information to help verify your employment.

Once approved, your application will be reviewed and you will receive your loan funds the next business day. You should remember that late payments can damage your credit score and result in fees.

Requirements for getting approved

Short term loans are an easy way to get a cash advance, and there are plenty of lenders out there to choose from. Oftentimes, you can apply online in just two minutes and compare rates from several lenders. Even with a bad credit history, getting approved for a short-term loan is possible.

The requirements for getting approved for a short-term loan depend on where you live. Some companies require more information, while others don’t. Some lenders will require a credit check, income verification, and proof of address. You also must be over 18 years of age to apply.

These loans are often more expensive than other types of loans, but they are an excellent option for people who need lump sum cash in a few days. In contrast, credit card cash advances usually charge high interest rates and are limited to the amount of available credit. Requirements for getting approved for t a short term loan online can vary, but the majority of short term loan applications only require a few simple requirements. For example, most online forms will ask for proof of income, your address, and your bank account information. They also generally do not require rigorous credit requirements, which makes them a good choice for those who need emergency cash.

Credit scores are one of the main factors affecting approval. Most lenders have a minimum credit score of six hundred and higher, but they do vary. Generally, you should aim for a credit score of 720 or higher to receive the best terms. Likewise, your income needs to be steady and consistent. Your DTI ratio should be below 36%. If you meet these requirements, you will increase your chances of getting approved for a short-term loan online.

Before applying for a short term loan, you should determine your budget and monthly income. This will help you determine how much money you need to borrow and what type of loan you should get. You should also know what type of repayment schedule you can manage. Some loans require a higher monthly payment than others, which can put added stress on your budget. Some loans also require upfront fees and high interest rates.

Repayment period for short-term loans

Once you’ve applied for a short-term loan, the next step is to decide how much money you need and how long you’ll need to pay it back. In most cases, repayment will be done monthly in instalments. The amount of each instalment will be deducted from your checking account on the date that you’ve agreed on. This cycle will continue until you’ve paid off the entire loan amount.

While many short-term loans can be difficult to qualify for, the terms are typically much shorter than those for more traditional loans. Repayment periods are typically between six months to 18 months. This type of loan is designed to provide you with just the money you need to get through an emergency and move on with your life.

When applying for a short-term loan online, make sure to know how long you can pay it off. While a short-term loan can be used to cover a variety of needs, you should never use it for frivolous expenses, such as a washing machine replacement that costs a few hundred pounds. It’s important to make sure that you can make your repayments on time – if you are unsure of your ability to pay, get a credit counselor to help you.

Cost of borrowing money

If you are in need of a short-term loan, you may want to look around for the lowest interest rate. However, be careful to check the fine print. Some lenders have hidden fees that can increase the overall cost of borrowing money. These fees may include late fees or pre-payment or renewal charges. It is best to have a clear repayment plan and stick to it to avoid any additional fees.

Fortunately, most short-term loans are easy to apply for, and you can often get approved online. You’ll need to provide basic personal information and proof of your financial standing. You’ll likely be asked for your salary and employment status, and you may also have to provide your address and credit history. If the lender needs additional information, they’ll contact you to request it. Otherwise, a short application will often suffice.

If you’re in need of a small amount of money, you may need to consider a short term loan to cover startup costs or emergency expenses. This type of loan can help you get through a financial crisis quickly. Other common reasons to apply for short-term financing include operational costs, such as travel, utilities, maintenance, office supplies, rent, and property taxes.

As a general rule, short-term loans have higher interest rates than traditional loans. Many lenders charge a fee of between 10 and 30 percent per hundred dollars borrowed, and you may need to pay additional fees if you miss a payment or do not pay it on time. Some lenders also charge monthly fees or late fees.