A short term loan is one that is used for a single purpose. They provide liquidity and usually have lower interest rates. They can also be a good option if you have less than stellar credit. They are unsecured and have a shorter repayment period than other types of loans. In addition, they can cover an estimated 50% to 90% of your outstanding invoices.

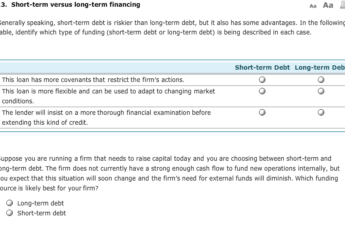

Short-term loans offer liquidity

Short-term loans offer liquidity to small-time borrowers, who are often pressed for money. This type of loan carries a lower interest rate than other forms of financing, but the borrower must be able to pay it back within the loan’s tenure. In addition, these types of loans may boost a person’s credit score, which is useful for larger loans later.

In the business world, short-term loans are a great way to supplement the working capital of a business. They are especially useful for small businesses who don’t have access to a line of credit from a bank. As their duration is so short, they are easier to obtain and process. They are also low-risk because the repayment period is so short.

The advantage of short-term loans is that they are more flexible. Short-term loans are often offered at lower rates than long-term loans, which helps businesses diversify their capital portfolio and reduce their dependence on one capital source. Also, these loans usually have shorter maturities, making them better suited for fluctuations in working capital. Traditionally, short-term loans are provided by banks and have floating interest rates. However, some companies artificially fix floating rates with financing derivatives.

Short-term loans are easy to obtain online, and the money is wired to the borrower’s bank account once the application is approved. In some cases, these loans are based on a business’s accounts receivables. During a bad credit period, a borrower may need cash quickly to pay off expenses.

They are unsecured

Unlike a personal loan, a short term loan doesn’t require collateral. This means that you can use the money for any purpose. A short term loan can be used for anything from a wedding to paying off education fees, to purchasing household furnishings, to renovating a home, or even for a medical emergency. These loans are perfect for people who need money quickly, but can’t afford to take out a long-term loan.

Because they are unsecured, short-term loans often have higher interest rates. Make sure you research lenders carefully before applying. This will avoid the risk of having your credit adversely affected. It also helps if you have a relationship with a bank that will improve your chances of being approved. It is a good idea to do a credit check before applying for any type of loan, since a bad credit history can be a deterrent.

Most short-term loans are unsecured, but there are a few secured types that require collateral. For example, if you’re looking to buy a new car, you could use the title to your car as collateral. Secured loans typically have lower interest rates than unsecured loans, but you risk losing your collateral if you don’t repay the loan. Another option is an installment loan, which requires monthly payments, with a set end date.

Another type of short-term loan is called a signature loan. While these loans are unsecured, they do have a higher interest rate because you’ll have less time to pay them off. Unless you have good credit, you can easily end up with a large principal balance if you can’t repay it.

They accumulate less interest

While short-term loans accumulate less interest than longer-term loans, they do carry higher interest rates. This is because the lender “frontloads” interest that would have accrued over time. This arrangement works well as long as the borrower repays the loan on the agreed schedule. But if the borrower fails to repay the loan on time, it could cost a lot of money.

Another difference between short-term and long-term loans is the length of the repayment period. Short-term loans accumulate less interest because the repayment term is shorter. The lender can collect a higher profit when a loan is repaid faster. Short-term loans also tend to be lower in amount, which makes them cheaper for lenders.

They are used for one specific purchase or for one sum of money

Short term loans are unsecured loans that are intended for one specific purchase or a one-time sum of money. They are intended to be repaid in a very short period of time, which is why they are not the best option for everyday purchases. They are usually used for emergencies, or for expenses that exceed the credit limit on a credit card. Credit cards often have a longer grace period, and may come with a lower interest rate.

They are a good alternative to long-term loans

If you’re looking for a loan that will give you the money you need for a short amount of time, you may want to consider short term loans. These types of loans typically last for three to 18 months. Although these are convenient, they’re not always the best option. Taking out too many of these loans can lead to overspending and wasting your money.

Short-term loans are easy to apply for, have flexible eligibility requirements, and are often used for a variety of expenses. These loans typically offer between a few hundred to several thousand dollars in funding. While this amount may be inadequate for specific expenses, it can help you get through an emergency until you can afford a larger loan.

However, short-term loans are not always the best choice. Although the repayment period is shorter, they usually come with higher interest rates. While these loans are a good option in some cases, it’s best to consider the terms and the repayment schedule before committing to them.

Although short-term loans are convenient and relatively easy to qualify for, there are some disadvantages to them as well. While they have low interest rates, they’re not always the best option for people with bad credit or low credit scores. This is why people with bad credit should use short-term loans as a last resort.

They are used by individuals and businesses

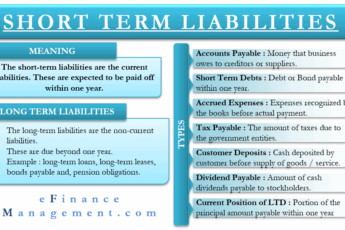

Short term loans are unsecured loans that are taken out for a short period of time, typically six months or less. They are used by individuals and businesses to meet short-term monetary needs. Many short-term loans are obtained via bank overdrafts. The term of the loan varies, but many mature in six to twelve months and some last for up to two years. The purpose of these loans is to help meet a temporary cash flow shortage, such as an unexpected emergency.

Short-term loans usually have short repayment periods, so only take them if you know you can afford to pay them back quickly. The borrower typically makes payments on a daily or weekly basis. This frequency is especially important for businesses with fluctuating cash flow. While a short-term loan may be an excellent choice for some businesses, it is not for everyone.